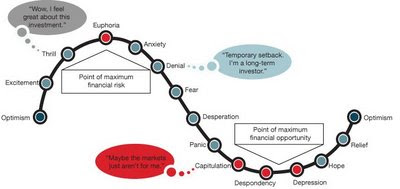

Last quarter we discussed giving up resistance, or capitulation, in the markets. In the cycle of market emotions “the bottom” is scary. Starting over requires rebuilding confidence and attention to fundamental investment principles in spite of an uncertain future. Understanding how we came to this point in the market cycle can give us an indication of the road ahead.

Last quarter we discussed giving up resistance, or capitulation, in the markets. In the cycle of market emotions “the bottom” is scary. Starting over requires rebuilding confidence and attention to fundamental investment principles in spite of an uncertain future. Understanding how we came to this point in the market cycle can give us an indication of the road ahead.

How did we get here?

The length and depth of the housing lead downturn have been underestimated multiple times over the past eighteen months. Each time it looked like we were starting to stabilize, more bad news deepened the recession. It started with losses in the banking sector, resulting from derivatives backed by housing, then it was skyrocketing commodity prices, then consumer confidence fell, then the credit crisis spread to all sectors and asset classes, then the stock market crashed, and now retailers and auto manufacturers are taking a hit. As this report illustrates, we are now seeing the impacts of that cycle show up in the commercial markets, with accelerating vacancy rates and falling lease rates.

What will lead us out?

So, if all of this bad news has resulted in more bad news, how do we get out? Housing was the signal that lead us into this recession and housing will be the signal that leads us out. Housing will be considered in recovery when prices and volumes stop falling. Relief in the

housing market will stop the

pressure to shed Capitulation jobs and operations that affect businesses occupying office and industrial space. Relief in the housing market will also provide relief to homeowners who have watched their net worth fall, which has impacted confidence and consumer spending. Lastly, a s table housing market will signal the beginning of the end of bank losses, of retailer closures, and of reductions in aggregate demand.

table housing market will signal the beginning of the end of bank losses, of retailer closures, and of reductions in aggregate demand.

We have weathered eighteen months of one of the most challenging cycles in memory. The inset chart illustrates the emotional rollercoaster of the past couple of years. Just three years ago, no one could go wrong whereas three years from now we will probably be saying the same thing. While there will be more challenging months ahead, we are eighteen months closer to a recovery than when the bad news started. That is all good news.

Written by Neil Walter – December 2008

For more commercial real estate articles please click here: https://www.excelcres.com