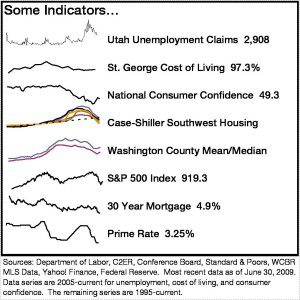

Technically, to remain in recession, the economic environment must continue to get worse. While the rate of decline is decelerating, growth remains elusive suggesting there are more difficult times ahead. Recently, some indicators have shown “green shoots” (see inset table) and reports from CNN, Business Week, the Wall Street Journal, and the Federal Reserve predicted the end of the recession in the second half of this year. Although the recession may end in 2009, it does not mean the economy has recovered. A full recovery will require absorption of excess production capacity, and in the commercial markets, excess space, which is going to take us most of 2010 and likely into 2011.

Technically, to remain in recession, the economic environment must continue to get worse. While the rate of decline is decelerating, growth remains elusive suggesting there are more difficult times ahead. Recently, some indicators have shown “green shoots” (see inset table) and reports from CNN, Business Week, the Wall Street Journal, and the Federal Reserve predicted the end of the recession in the second half of this year. Although the recession may end in 2009, it does not mean the economy has recovered. A full recovery will require absorption of excess production capacity, and in the commercial markets, excess space, which is going to take us most of 2010 and likely into 2011.

The news cycle has shifted slightly as some indicators are showing positive signs. Utah weekly unemployment claims peaked in January and nationally in March. Consumer confidence is up nearly 100% to a reading of 48.9 after falling to a low of 25.3 earlier this year. It regularly registered over 100 prior to the recession. Housing markets are making an effort to stabilize. Wall Street Journal has reported twice on improvements in Southern California transaction volumes and even CNBC’s Jim Cramer called a bottom to the national housing crisis and told viewers to buy homes. Locally, home buyers are getting very good deals on homes that have seen significant price reductions and the months of April and May showed slightly better volumes year over year. Last, the stock market locked in its best quarter in over 30 years and interest rates remain extremely low.

Why doesn’t the recovery occur more quickly? The biggest obstacle to getting the economy on track is uncertainty. Unfortunately, the Federal Government has been the biggest contributor to uncertainty by intervening in markets and over committing public resources. The bulk of the stimulus package passed in the first quarter will come too late to create jobs and stabilize the economy this year; on the other hand, local public works projects including the courthouse, the airport, and the many road projects are underway at just the right time.

A full recovery will include the housing and financial sectors healing. It will also include continued improvement in consumer confidence levels, retail sales, and lower business inventories. As it relates to commercial real estate, investment sales activity will increase as buyers anticipate better market conditions. Leasing activity will improve next as overall business conditions get better, and commercial construction will significantly improve when much of the excess commercial space has been absorbed.

We believe in Southern Utah, its resilience, and the resourcefulness of the community. We believe it is a great place to work, play, and raise a family. As the economic environment starts to improve over the next couple of quarters , vacancies and lease rates will stabilize and eventually recession will be replaced with a more friendly “r” word–recovery.

Written by Neil Walter – July 1, 2009