Q2 2024 Comments

On July 7, Las Vegas broke its all-time temperature record, reaching 120°F at Harry Reid International Airport, surpassing the previous high of 117°F set in 1942. Amidst the heat, the industrial real estate market in Las Vegas has unfolded as anticipated this summer, with slowing demand and rising vacancies. Despite expectations for decreasing rental rates, they have remained relatively steady. Notably, North Las Vegas distribution rates have dropped to

the mid to high $0.80’s per square foot from a high of +/- $1.10 per square foot. Landlords increasingly secure deals through concessions such as tenant improvement allowances, early access, and abated rents, rather than lowering rates. Unlike the weather, no records have been set in the industrial real estate market, but the volume of concessions, including free rent, is nearing levels not seen since the financial crisis.

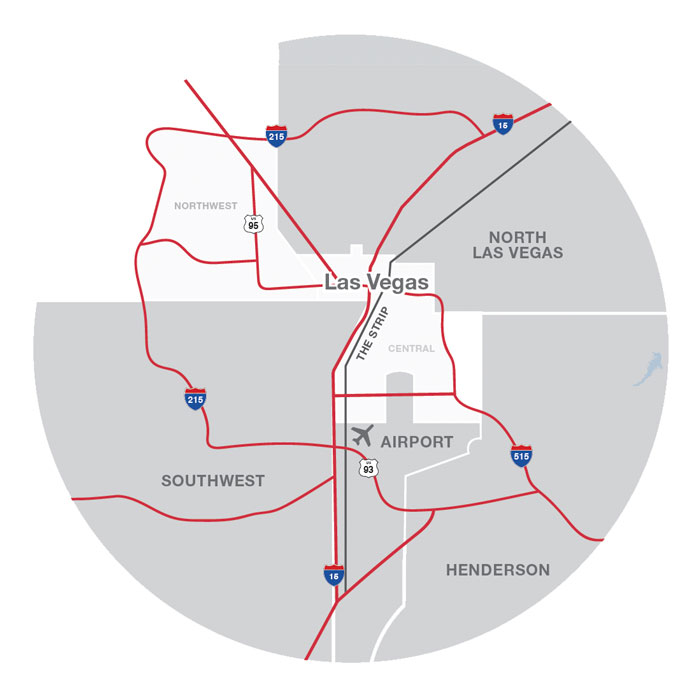

| Submarket | Standing Inventory | Under Construction | Under Construction Available | Under Construction Pre-Leased | Planned |

|---|---|---|---|---|---|

| North | 6,742,506 | 10,811,893 | 9,170,841 | 1,641,052 | 14,992,414 |

| Southwest | 66,000 | 2,969,291 | 2,251,071 | 718,220 | 2,291,000 |

| Henderson | 569,300 | 5,522,166 | 5,489,410 | 32,756 | 3,572,200 |

| Airport | 37,500 | 32,000 | 32,000 | 0 | 43,299 |

| TOTAL | 7,415,306 | 19,335,350 | 16,943,322 | 2,392,028 | 20,898,913 |

Construction.

According to CoStar, industrial deliveries in Las Vegas are set to reach a record high in 2024, with 13 million SF slated for completion. This will expand the inventory by over 7%, surpassing the past five years’ 4% annual growth rate. Late- 2023 construction starts remained strong, with nearly 6 million SF breaking ground in the year’s second half. Nationally, construction starts have slowed below the three-year average during the same period. With over 17 million SF under construction in early 2024, vacancies may increase faster than the national average. The total space under construction represents 10% of existing

inventory in Las Vegas, compared to 2.2% nationally. Approximately 70% of the industrial space currently being built is available for lease, higher than the national rate of 55%. Projects of 400,000+ square feet face significant challenges, with leasing in this segment virtually nonexistent in the past year. About 17% of the inventory of properties 400,000 square feet or larger is available for lease, nearly double the national rate of 9.6%, making it one of the highest comparable rates in the U.S.

Henderson — Rental Rates | ±50,000 SF – $1.10-$1.12 | ±150,000 SF – $1.05-$1.10 Sale Comp: May 15th,2024 – T Brokers Tile bought 941 Empire Mesa Way., 6,869 SF building – $237/SF. | Sale Comp: May 23rd, 2024 – A private investor purchased 1735 Chaparral Rd., a 98,023 SF NNN leased investment for $284/SF – Pro Forma cap rate of 4.91%.

Submarkets.

North Las Vegas — Rental Rates | ±50,000 SF – $1.00-$1.10 | ±150,000 SF $0.90-$0.95 Sale Comp: May 8th, 2024— Panda Window & Doors expanded with a 41,309 SF building at 3865 N. Pecod Rd., for $237/SF. | Sale Comp: May 30th, 2024 —IOS fund purchased XPO truck terminal with a short lease for $38/SF.

Southwest — Rental Rates | ±50,000 SF – $1.15-$1.30 | ±150,000 SF – $1.05 – $1.15 Sale Comp: April 26th, 2024 – IOS fund acquired a 20- yr NNN lease on a 4.54-acre low-coverage property for $31/SF. | Sale Comp: May 2nd, 2024 —Freestanding 42,645 SF building, sold to a mechanical contractor user for $258/SF.

Airport — Rental Rates | ±50,000 SF – $1.15-$1.30 | ±150,000 SF – $1.05-$1.15 Sale Comp: June 24th, 2024—32,756 SF dock-high new build, sold to a construction user for $256/SF. The user unit is shell, and the for-lease unit is turn-key.

Eric Larkin

Mr. Larkin joined NAI Vegas in 2013 with 7 years of experience coming from a regional brokerage firm specializing in representing institution landlords, REITs, insurance companies, lenders, receivers, and developers. Mr. Larkin’s extensive knowledge and understanding of investment analysis, property valuations, and lease negotiations has resulted in the completion of over 100 million dollars in transactions including leases, REO and distressed debt sales, trustee sales, and short sales.

Michael Kenny

Michael is well versed in Real Estate and brings a unique background of finance and civil construction to his clients along with proven results and an unrivaled level of service. He works diligently with his clients to identify every opportunity, add value, and continually cultivates each relationship to help achieve their goals.

Leslie Houston

Leslie Houston joined NAI in 2018 after seven years of experience with a third party commercial real estate database, formerly known as one of the Top 2 commercial real estate information providers. Leslie came to Vegas with an extensive real estate network from coast to coast. She possesses a very unique subset of skills which includes all property types, all listing types, analytics, and research. Coaching, supervision, and customer service have been major components throughout Leslie’s career and are proving to directly relate to her new role within the Larkin Industrial Group.

Zach M. McClenahan

Zach is a Las Vegas native ad second-generation Commercial Real Estate professional. He joined the Larkin Industrial Group in 2021 while completing his bachelor’s degree in finance at the University of Nevada, Las Vegas. Zach has played competitive hockey in Tier-1 Elite Leagues and is just as competitive on the golf course. When not utilizing his attention to detail towards studies or Industrial Real Estate brokerage support, he often serves for local volunteer organizations such as Three Square.

About NAI Excel

NAI Excel is a leading provider of commercial Real Estate Services in the US. Operating in Utah, Nevada, Texas, and Idaho, they are part of the NAI Global network covering nearly every major market nationally and across the globe. NAI Excel is a subsidiary of Brokers Holdings, LLC. Headquartered in St George, UT since 1982, Brokers Holdings owns and operates both residential and commercial brokerages. With over 800 agents and staff, Brokers Holdings closes over 5,500 transactions worth more than $2 billion in value each year and manages over $1 billion in assets.

About NAI Global

NAI Global is a leading global commercial real estate brokerage firm. NAI Global offices are leaders in their local markets and work in unison to provide clients with exceptional solutions to their commercial real estate needs. NAI Global has more than 300 offices strategically located throughout North America, Latin America, Europe, Africa and Asia Pacific, with over 5,100 local market professionals, managing in excess of 1.1 billion square feet of property and facilities. Annually, NAI Global completes in excess of $20 billion in commercial real estate transactions throughout the world.