Outlook.

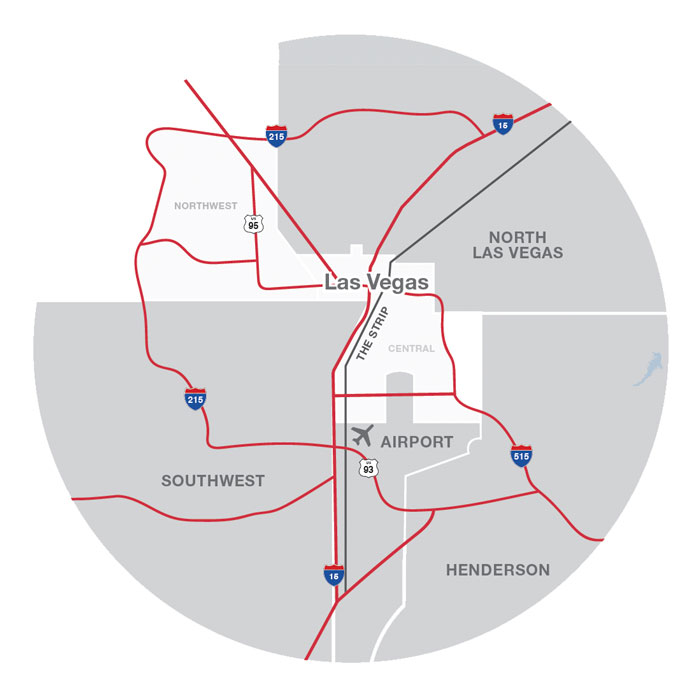

Amidst The Great Supply Chain Disruption of 2021, a “No Vacancy” sign has started to flicker over Las Vegas’ industrial market. In North Las Vegas, the submarket largely responsible for adding 45 million square-feet of economic diversity over the last seven years, there is no immediate option if you need new, concrete tilt-up, distribution space. One of multiple tenant prospects will soon occupy the last available unit within the area’s standing inventory at 171,000 square feet.

The availability of other product types, and within other submarkets, is similarly scarce. As one would expect, low supply and high demand continue to push up rents across the board. Pre-leasing is up 55% quarter over a quarter, while standing inventory is down almost 400% in the same period. Tenants are committing to space early or having to consider other markets. California relocations and 1031 exchange money drive the Las Vegas market. While our industrial market dynamics seem extreme and expensive, we are still a bargain compared to our neighboring state of California.

Significant Q3 Transactions

| Submarket | Standing Inventory | Under Construction | Under Construction Available | Under Construction Pre-Leased | Planned |

|---|---|---|---|---|---|

| North | 170,982 | 8,248,040 | 4,254,434 | 3,980,606 | 6,992,863 |

| Southwest | 89,712 | 1,032,677 | 702,902 | 329,775 | 1,399,331 |

| Henderson | 130,220 | 3,626,381 | 2,665,466 | 960,915 | 258,021 |

| Airport | 0 | 409,500 | 258,300 | 151,200 | 150,120 |

| TOTAL | 390,914 | 13,316,598 | 7,881,102 | 5,422,496 | 8,800,335 |

Construction.

Our 13 million square feet of construction looks healthy—however, timing and ongoing demand present challenges. By most estimates, we have over 10 million square feet of demand, equating to just over a one year supply of space. Adding further strain are delayed construction deliveries resulting from supply chain disruptions. Roof components, dock packages, and things as simple as nails are difficult to find or are slow to arrive. The resulting delays for deliveries in 2022 and even 2023, make the next 12 months hyper-competitive.

Developers are still bullish on space demand and rent growth, which continues to push land prices higher. Any available parcel of significant size gets interest from a long list of developers. Project announcements as small as 25,000 square-feet on smaller lots are a welcome new trend, but delivery dates will be fluid. In a recent McCarran Airport Auction, several parcels that looked suitable for industrial development went to apartment developers willing to pay over $1 million per acre.

East Henderson — Like the airport area, for-sale and for-lease pricing mirror the Southwest with less runway to finish 2021.

West Henderson — West Henderson is still in the pricing discovery stages on a for-sale basis but on pace to be the most expensive submarket in town. Shell buildings should close at well over $200 a square foot. Leasing rates are on pace with Southwest and, in some cases, more expensive.

Submarkets.

North Las Vegas — A North Las Vegas discount is nearly unrecognizable, with mid to high $0.60’s SF/M for distribution units. Tenants must request proposals to see actual rates, and the quoted rent may increase if not locked in. Smaller spaces can be $0.70 – $0.90 SF/M. A 19,000 SF NNN leased dock-high building occupied by Goodman is seeking $200 a square foot.

Southwest — A 40,000 SF dock-high building just south of the Stadium District is listed at $261 per SF and rumored to be in escrow. Another similar building in the Stadium Area is asking $250 per SF. Multiple comps prove at least $225 per SF, but another 10%-15% pricing jump feels imminent by the year’s end. Lease rates hover around $0.95 to $1.05 SF/M with dock-high distribution buildings under construction, expecting closer to $1.25 SF/M when delivered next year.

Airport — Rents and pricing are similar to the Southwest, with lesser signs of an immediate increase by the end of 2021. Expect a maximum of $225 per SF.

Notable Transaction.

“When we planned a west coast manufacturing facility, we trusted NAI Global for market expertise in Las Vegas. Mike Kenny and his team at NAI Vegas were referred and did not disappoint. Evanesce secured an ideal North Las Vegas location, in a hyper-competitive market, and signed before a significant increase in rental rates.”

– Scott Duddy, Chief Operating Officer

Challenge.

At Evanesce, developing innovative technologies to replace single-use plastics and Styrofoam gained significant momentum. To meet the growing demands of sustainable packaging alternatives, they needed distribution centers from coast to coast.

Action.

The leadership at Evanesce looked to NAI Global for logistics expertise on the west coast. The NAI global network of real estate professionals was the perfect resource for site selection. They selected Las Vegas, NAI Vegas, and the Larkin Industrial Group.

Results.

Evanesce will disrupt the $980 billion packaging industry with innovative solutions for consumers, the food industry, and the planet from a new NLV location. Their new facility is under construction and will be ready for 2022 operations.

This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty, or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction on the suitability of the property for your needs.

Eric Larkin

Mr. Larkin joined NAI Vegas in 2013 with 7 years of experience coming from a regional brokerage firm specializing in representing institution landlords, REITs, insurance companies, lenders, receivers, and developers. Mr. Larkin’s extensive knowledge and understanding of investment analysis, property valuations, and lease negotiations has resulted in the completion of over 100 million dollars in transactions including leases, REO and distressed debt sales, trustee sales, and short sales.

Michael Kenny

Michael is well versed in Real Estate and brings a unique background of finance and civil construction to his clients along with proven results and an unrivaled level of service. He works diligently with his clients to identify every opportunity, add value, and continually cultivates each relationship to help achieve their goals.

Leslie Houston

Leslie Houston joined NAI in 2018 after seven years of experience with a third party commercial real estate database, formerly known as one of the Top 2 commercial real estate information providers. Leslie came to Vegas with an extensive real estate network from coast to coast. She possesses a very unique subset of skills which includes all property types, all listing types, analytics, and research. Coaching, supervision, and customer service have been major components throughout Leslie’s career and are proving to directly relate to her new role within the Larkin Industrial Group.

Erik Sexton

Erik Sexton joined NAI Vegas in 2017 as a Senior Vice President and Industrial Specialist. He has more than 14 years experience in the leasing and sales of industrial and office spaces. During his real estate career, Mr. Sexton has represented a diverse segment of location and national companies that include Genesis Gaming, SME Steel, Ice Now, High Impact Signs, Next Century Rebar, JAMO Performance Exhaust, Chicago Exhibit Productions, Coca Cola, and 99 Cent Stores Only.. As a licensed agent, he has brokered more than 1.8 million square feet of commercial space totaling more than $179 million.

Bryan Houser

Bryan specializes in the representation of landlords and tenants in the leasing, acquisition, and disposition of Industrial and Office properties throughout Southern Nevada and the Southwestern U.S. He recently completed the NAIOP Developing Leaders program and attributes much of his success to his “client first” focus; ensuring that his clients’ needs are placed above all others and the outcomes are in their best interest. “I get satisfaction from providing a smooth successful transaction for my Landlord, Tenant and Investment clients, and in knowing they are satisfied with the outcome of the deal.”

About NAI Vegas and NAI Excel

NAI Excel and NAI Vegas are leading providers of commercial Real Estate Services in the West. Operating as NAI Vegas in Nevada, and NAI Excel in Utah and Idaho, we are part of the NAI Global network covering nearly every major market nationally and across the globe. Serving both urban and rural markets, we leverage our resources to help you excel in your real estate goals. When you work with one of our team, you get the benefit of working with all of us.

About NAI Global

NAI Global is a leading global commercial real estate brokerage firm. NAI Global offices are leaders in their local markets and work in unison to provide clients with exceptional solutions to their commercial real estate needs. NAI Global has more than 375 offices strategically located throughout North America, Latin America and the Caribbean, Europe, Africa and Asia Pacific, with 6,000 local market professionals, managing in excess of 1.15 billion square feet of property and facilities. Annually, NAI Global completes in excess of $20 billion in commercial real estate transactions throughout the world.

NAI Global provides a complete range of corporate and institutional real estate services, including brokerage and leasing, property and facilities management, real estate investment and capital market services, due diligence, global supply chain and logistics consulting and related advisory services. To learn more, visit http://www.naiglobal.com