Q3 2024 Comments

As we roll into the fourth quarter, the industrial real estate market in Las Vegas is like a seasoned poker player—calm, collected, and not in a rush to make bold moves. While the strip sizzles with tourist traffic, the industrial sector shows poise as tenant activity in the 50,000 to 150,000 square-foot range is steady against the backdrop of 20+ options in the North Las Vegas submarket. It’s a quiet methodical game, with landlords opting to throw in concessions

like tenant improvement allowances and free rent rather than lower rates. You could say the market’s holding its cards, waiting for the river card, with no one folding yet. Rental rates are steady, and vacancies have ticked up to 8.6%, which hardly causes alarm. All is healthy around the valley, apart from the North Las Vegas distribution challenges. This isn’t a market looking for a hot streak—just keeping pace as expected.

| Submarket | Standing Inventory | Under Construction | Under Construction Available | Under Construction Pre-Leased | Planned |

|---|---|---|---|---|---|

| North | 6,619,673 | 10,922,893 | 8,697,481 | 2,225,412 | 14,881,414 |

| Southwest | 66,000 | 3,231,291 | 2,513,071 | 718,220 | 1,867,000 |

| Henderson | 569,300 | 6,909,210 | 6,909,210 | 0 | 2,152,400 |

| Airport | 37,500 | 32,000 | 32,000 | 0 | 43,299 |

| TOTAL | 7,292,473 | 21,095,394 | 18,151,762 | 2,943,632 | 18,944,113 |

Construction.

For the past three months, the numbers are consistent in the Las Vegas industrial market—no significant changes, no surprises. But the real buzz is around the progress made on 21 million square feet of construction, steadily pushing towards completion. It’s like watching a poker game where the pot keeps growing, and everyone’s waiting to

see who makes the next move. In the next 6 to 9 months, we could see the standing inventory number skyrocket, adding a massive stack of space to the market. All eyes are on the table as the pot grows, with everyone waiting to see how the cards fall in this high-stakes development and leasing game.

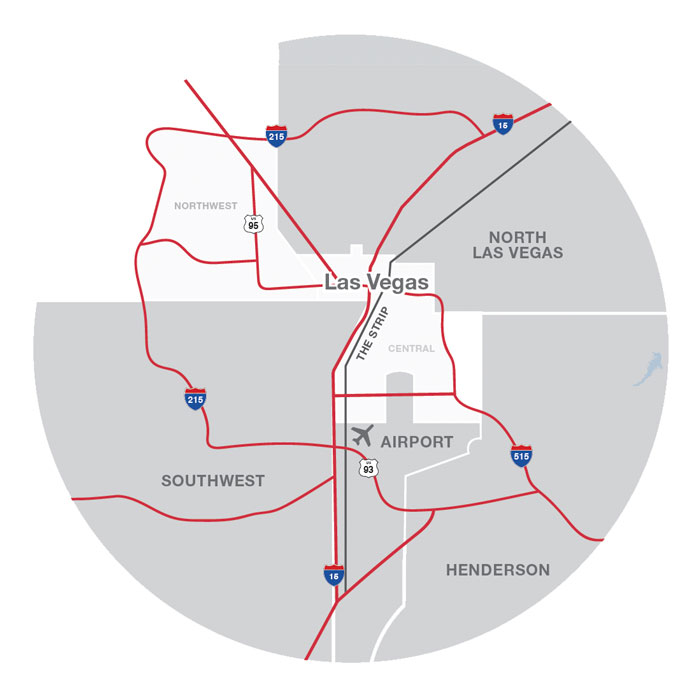

Submarkets.

North Las Vegas — Rental Rates | ±50,000 SF – $0.95-$1.05 | ±150,000 SF – $0.88-$0.95 Sale Comp: August 22nd, 2024—CNC Cabinetry pays $185/SF for recently completed turn-key 89,284 SF distribution facility with 3,500 SF office. Address: 2770 N. Lamb Blvd | Sale Comp: September 19th, 2024 — Theming & Millwork Concepts buys 3470 John Peter St, a 23,579 SF building, for $219/SF. Address: 3470 John Peter Lee St.

Southwest — Rental Rates | ±50,000 SF – $1.15-$1.30 | ±150,000 SF – $1.05 – $1.15 Sale Comp: August 23rd, 2024— Investor bought a fully occupied twotenant 35,446 SF industrial building for $291/SF at 5.5% cap. Address: 6260 W. Pebble Rd | Sale Comp: July 15th, 2024 — High image dock-high building sells to an Owner User (Stickers Banners) for $339/SF sets market high. Address: 7485 W. Badura Ave.

Airport — Rental Rates | ±50,000 SF – $1.15-$1.30 | ±150,000 SF – $1.05-$1.15 Sale Comp: August 2nd, 2024—Marx Digital Manufacturing buys a high-image 19,707 SF building with small yard for $284/SF. Address: 1850 E. Maule Ave.

Eric Larkin

Mr. Larkin joined NAI Vegas in 2013 with 7 years of experience coming from a regional brokerage firm specializing in representing institution landlords, REITs, insurance companies, lenders, receivers, and developers. Mr. Larkin’s extensive knowledge and understanding of investment analysis, property valuations, and lease negotiations has resulted in the completion of over 100 million dollars in transactions including leases, REO and distressed debt sales, trustee sales, and short sales.

Michael Kenny

Michael is well versed in Real Estate and brings a unique background of finance and civil construction to his clients along with proven results and an unrivaled level of service. He works diligently with his clients to identify every opportunity, add value, and continually cultivates each relationship to help achieve their goals.

Leslie Houston

Leslie Houston joined NAI in 2018 after seven years of experience with a third party commercial real estate database, formerly known as one of the Top 2 commercial real estate information providers. Leslie came to Vegas with an extensive real estate network from coast to coast. She possesses a very unique subset of skills which includes all property types, all listing types, analytics, and research. Coaching, supervision, and customer service have been major components throughout Leslie’s career and are proving to directly relate to her new role within the Larkin Industrial Group.

Zach M. McClenahan

Zach is a Las Vegas native ad second-generation Commercial Real Estate professional. He joined the Larkin Industrial Group in 2021 while completing his bachelor’s degree in finance at the University of Nevada, Las Vegas. Zach has played competitive hockey in Tier-1 Elite Leagues and is just as competitive on the golf course. When not utilizing his attention to detail towards studies or Industrial Real Estate brokerage support, he often serves for local volunteer organizations such as Three Square.

Seth Wright

Seth joined NAI Excel in 2024 after graduating from UNLV’s Lee Business School with a Bachelor of Science in Business Administration and an emphasis in Real Estate. He joined NAI Excel as part of the Larkin Industrial Group where he will help support the team in providing top-level advisory services to industrial occupiers throughout Southern Nevada.

Seth maintains strong roots to Orange County, CA where he was raised and has family. Outside of work, Seth enjoys fitness and exploring the outdoors.

About NAI Excel

NAI Excel is a leading provider of commercial Real Estate Services in the US. Operating in Utah, Nevada, Texas, and Idaho, they are part of the NAI Global network covering nearly every major market nationally and across the globe. NAI Excel is a subsidiary of Brokers Holdings, LLC. Headquartered in St George, UT since 1982, Brokers Holdings owns and operates both residential and commercial brokerages. With over 800 agents and staff, Brokers Holdings closes over 5,500 transactions worth more than $2 billion in value each year and manages over $1 billion in assets.

About NAI Global

NAI Global is a leading global commercial real estate brokerage firm. NAI Global offices are leaders in their local markets and work in unison to provide clients with exceptional solutions to their commercial real estate needs. NAI Global has more than 300 offices strategically located throughout North America, Latin America, Europe, Africa and Asia Pacific, with over 5,100 local market professionals, managing in excess of 1.1 billion square feet of property and facilities. Annually, NAI Global completes in excess of $20 billion in commercial real estate transactions throughout the world.