News Brief: Rising Rates and Commercial Real Estate

At its May policy meeting, the U.S. Federal Reserve increased its benchmark rate by 50 basis points (0.50%) – its largest rate increase in 22 years – and signaled that ‘ongoing increases in the target range’ are likely.

Latest news regarding rising interest rates and their impact on commercial real estate:

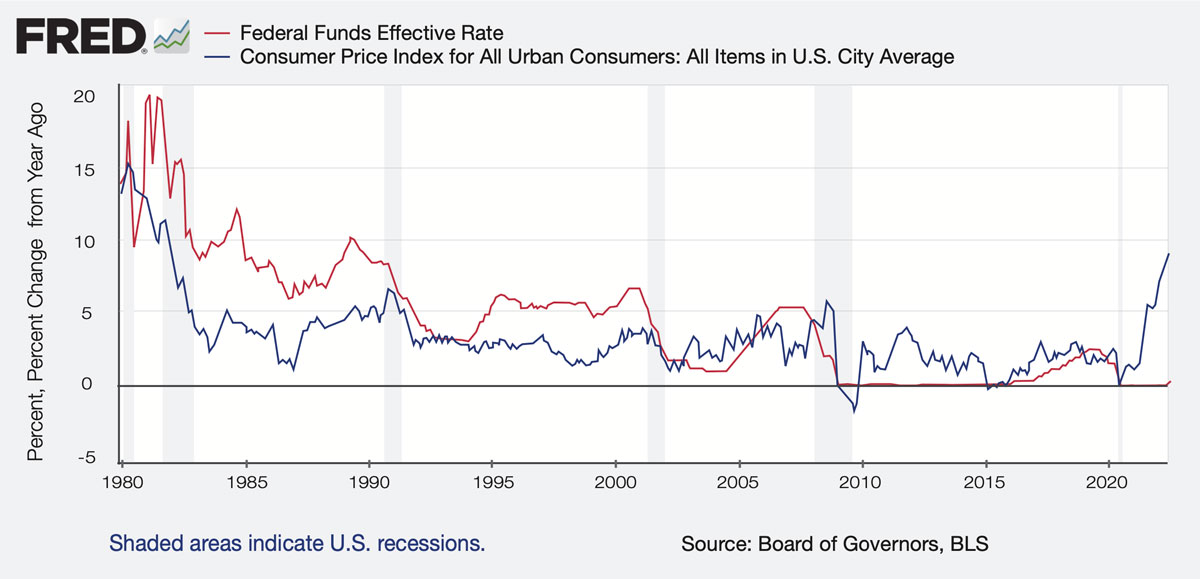

- With inflation running at its highest level in 40 years (see graph below), taming inflation has become the Fed’s top priority.

- Since March, the Fed has increased its benchmark rate from near zero, into a target range of 0.75% – 1.0%.

- Fed Chair Jerome Powell has stated that they will keep raising interest rates “expeditiously” until there is “clear and convincing evidence” that inflation is coming down, even if requires raising rates above “broadly understood levels of neutral”

- The neutral rate, which has been broadly understood to be around 2.0% – 2.5%, is the theoretical rate at which the Fed’s monetary policy neither boosts (accommodative) nor slows (restrictive) economic growth.

- The Fed has expressed optimism in executing a “soft-ish” landing, whereby inflation is brought under control without causing a recession; however, they also acknowledged doing so will require slowing growth and also may be partly out of their control, specifically referencing geopolitical events around the world.

- Fed funds futures have priced in over a 90% chance of another 50-basis point hike in June and an 80% chance of a third, 50 basis point hike in July, which would bring the target rate range up to 1.75% – 2.0%, where it was during the “goldilocks” economy in 2018. However, there is also growing sentiment among investors that a 75 basis point hike may be needed in one or both of the June and July Fed policy meetings.

- Rising rates’ impact on commercial real estate will depend on the severity of the increases, but even more so, on the health of the economy and on the amount of capital chasing commercial real estate. For example, though the Fed dropped rates by nearly 400 basis points in 2008, cap rates actually increased partly due to the perceived weakness and risk in the economy. Conversely, despite the Fed raising rates by over 200 basis points between 2016 and 2018, cap rates remained flat and even compressed for some products as the overall economy remained healthy.

Key Upcoming Dates:

June 10 – May CPI Data released by U.S. Bureau of Labor Statistics

June 14-15 – Next Federal Open Market Committee (FOMC) meeting

Sources: U.S. Bureau of Labor Statistics; Reuters; Wall Street Journal; MarketWatch; DallasFed;

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty, or guaranty, express or implied, may be made as to the accuracy or reliability of the information contained herein.

Todd Manning

Phone: 702.575.4866

Email: tmanning@naivegas.com

Jon Walter

Phone: 435.627.5719

Email: jwalter@excelcres.com