Question: What does the world’s most expensive car and your property have in common?

Answer: It turns out, a lot. But first let’s talk about the car.

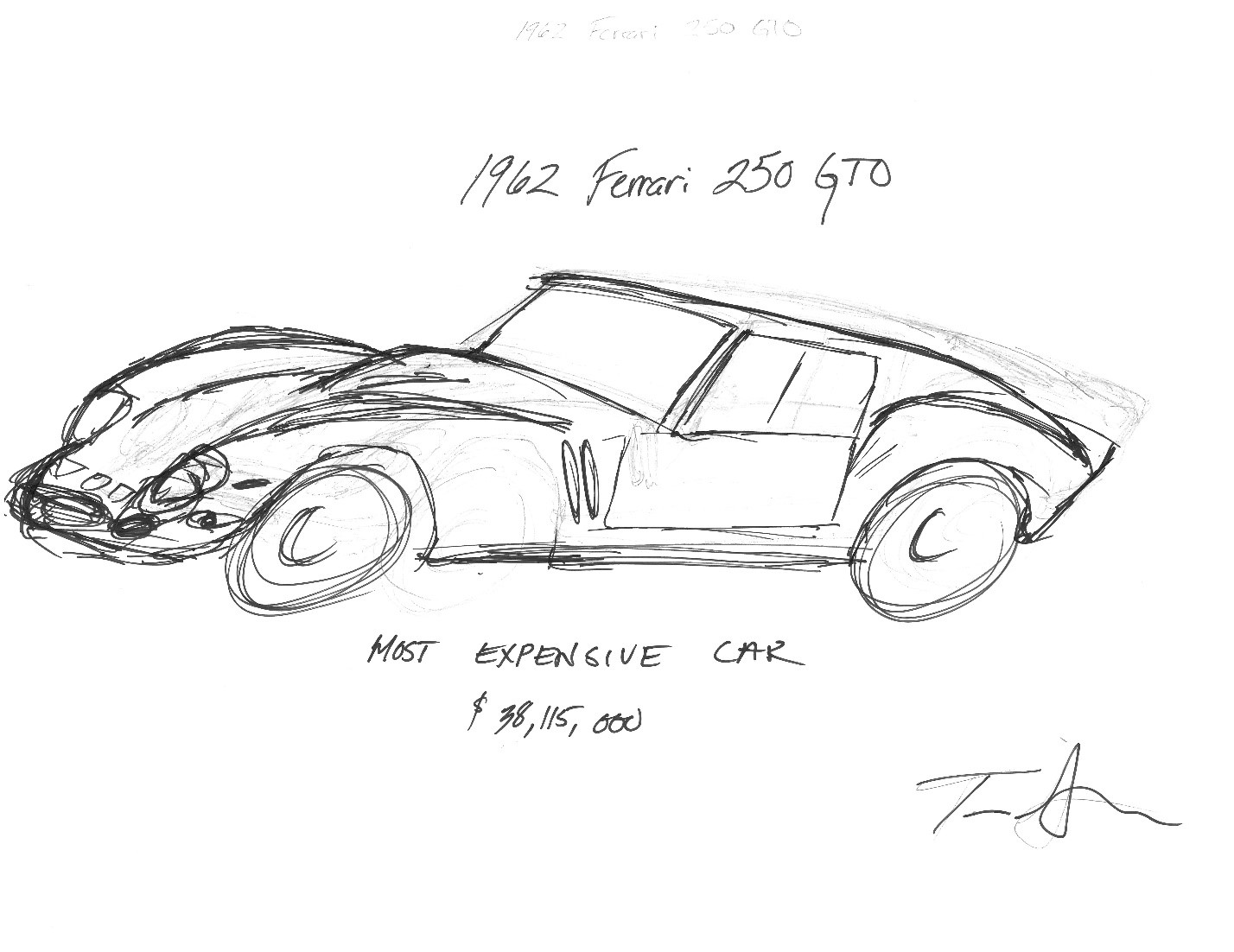

The 1962 Ferrari 250 GTO Berlinetta above (poorly sketched by me to avoid copyright issues) is valued at over $38 million dollars and will no doubt increase in value in the coming years as one of the most beautiful and rare Ferrari’s ever made. Now you may be asking why in the world would anybody spend that kind of money on a car? (By the way, it’s not just a car it’s a Ferrari) The simple answer is- they know that they are going to get their money back and then some when they decide to sell it. It’s an investment and, no that isn’t just a line men use on their wives as a persuasion tactic. In this case it’s true. Now the reason that this Ferrari is so valuable is because of its rarity, history and the near perfect condition that it is in. If the new owner wants to make sure that he gets an ROI on his investment then he needs to make sure that it stays in that condition. To that end the owner will hire only the most vetted and trusted experts to work on this car. Thus, ensuring the car’s value for years to come. (If you’re thinking of asking Santa for this car, too late it’s already on my list.)

Now, imagine if the new owner of this $38 million dollar Ferrari decided that he would like to make money off the care while he owns it. He decides to rent the Ferrari to drivers for a day at a time (I can hear the chorus of men yelling “NOOO!”). Now to protect the owner, each driver has to sign a rental agreement and be vetted that they know how to drive such a magnificent machine. This may sound ludicrous to you but the owner figures that if he does this then he will not have to come out of pocket for the monthly payments on the car and he still makes a pretty penny when he decides to sell it. He also understands that if he is going to do this then he needs a team of professionals to make sure that the car is always looking and running its best. If it works, then this owner can create a significant amount of wealth with this single asset.

Now, I know that the owners of these collector cars would never rent out their investments to drivers. Collector cars are very fragile investments, both literally and figuratively, however commercial real estate is much more stable.

The similarities of both a car collector and a commercial property owner appear in their financial expectations and their need for a competent team to help them reach their financial goals. They both want to get the most out of their assets and they both don’t want to have to bother with the tedious and time-consuming day-to-day operations. If both of the investments are managed well then these owners can count on a sizable ROI.

At NAI Asset Management we are your vetted and expert team. We manage your property so that it yields the greatest return on your investment. We work every day to ensure the highest long-termNOI for your asset thus ensuring the highest return. We handle the day-to-day operations to protect and increase the value of your property. Allow us the opportunity to share with you some of the successes that we have had and how our expertise and resources can benefit you.

Call or email me anytime.

Tim Stroshine

Real Estate Manager

436.627.5704