Not Like The Last Recession by R. Neil Walter

We are in Recession

The United States moved into recession because of COVID-19 and subsequent governmental actions. It hasn’t been confirmed by official statistics, that will take time. A recession is defined as two consecutive quarters of falling Gross Domestic Product (GDP). The first quarter of 2020 will show a small drop in GDP because of COVID-19 personal distancing measures and impacts to nonessential business implemented by governments in March. The second quarter will be a much larger drop due to the impacts.

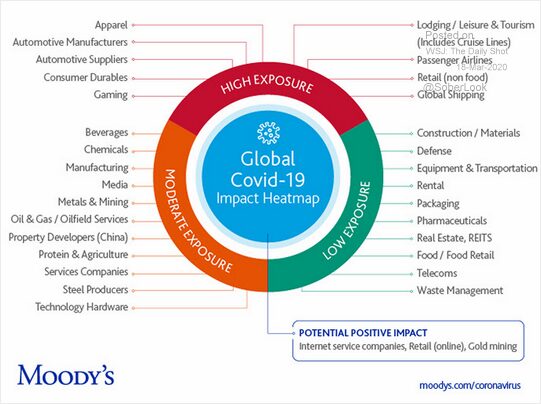

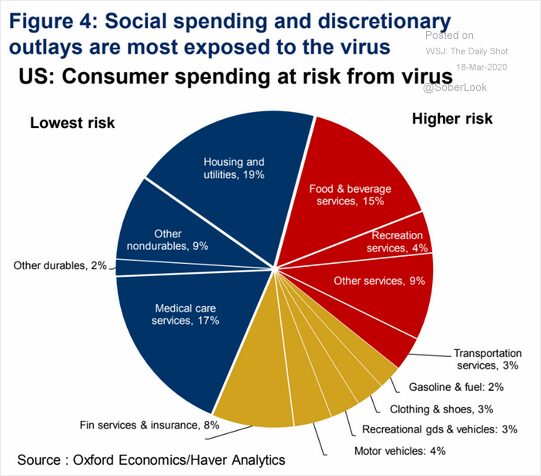

Which Sectors Will Be Hurt the Worst?

High exposure sectors include hospitality, travel, tourism, restaurants, airlines, and other businesses that put groups of people in close contact. The personal distancing measures governments have implemented will create residual reluctance for people to be in large groups and will slow recovery for some businesses. Further, any business or activities considered nonessential will be slower to rebound.

Who are the Winners?

First, winning in a recession is relative. Some will see revenues rise, but some may simply see revenues not fall as much as harder hit sectors. Delivery services will do well, online merchants will benefit. Personal services offered in homes will benefit. Healthcare, domestic manufacturing, transportation, housing, internet and communications services, and utilities considered essential will be more resilient and some will see upside.

Not the Same as Last Time

Each recession and recovery is different. The last recession was characterized by a surplus of homes built by home builders and inflated buyer demand from real estate investors buying homes no one planned to live in. It was made possible by the underwriting of loans where borrowers didn’t have sufficient income to support the debt service.

Contrast this with current real estate markets. First, home builders have built many homes, but in some cases at half the rate of the last market cycle. There is very little standing inventory, and the homes have been purchased by people who will occupy them, or investors with someone to rent them. Further, when the loans were originated, the investors who purchased the homes had the income to support the investments.

This recession was initiated by COVID-19 being declared a global pandemic and the actions of governments to implement personal distancing and close nonessential businesses. The government knowingly put the United States in recession in an effort to stop a global pandemic.

There will be softness in real estate. New home construction will be impacted more than residential resale. Expensive markets will be impacted more than affordable markets. Low growth markets will be impacted more than high growth markets. Retail will be impacted more than industrial. Hospitality and vacation rentals have the most exposure today. Interest rates will be low and there will be opportunities for buyers.

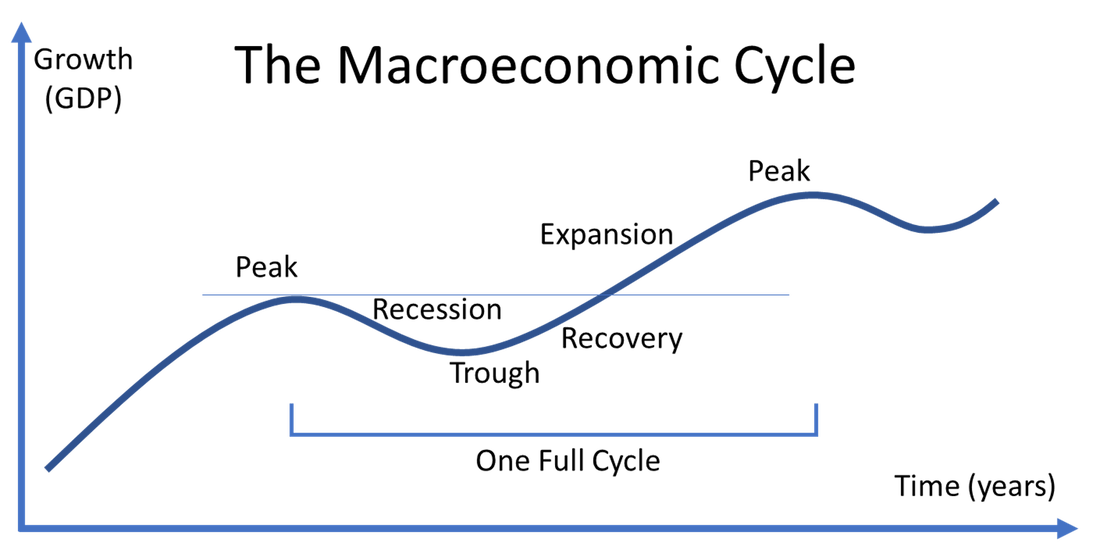

Recovery

The economy will adapt and recover. This recovery will be much quicker than the last one, but it still will take time. Unemployment will rise quickly and the hiring will be slow to recover because of an abundance of caution from employers. Recovery will begin when collective economic activity stops falling and starts growing again. The start of the recovery is not intuitive. It is when everything seems to be the worst. We call this the trough. The recovery lasts until we reach the peak of the last market cycle, which will be the fourth quarter of 2019. From there, we will resume economic expansion.

Looking Ahead

Everyone will adapt. Some adjustments will be easy, some will be hard. Individuals and businesses will make adjustments and we will begin a recovery. Some basic principles will persist. First, have cash set aside for a rainy day. Second, you can’t get credit when you need it most. Secure credit when times are good. Third, change is inevitable. We can’t always predict the source of change, but we can adapt and be responsive to change. Our world changed in the matter of a few months. The more quickly we make adjustments, the quicker we will begin the process of recovering.

Images Published by the Wall Street Journal Daily 03/19/2020

Neil is both partner and CEO for Brokers Holdings (NAI Excel). His client base is primarily focused on investment properties, development land, special use assets with or without the accompanying business, and difficult to sell REO properties. Neil’s professional experience is built on a capital markets foundation of deal structuring, cash flow modeling, and asset pricing. He has worked on projects including development land, multifamily and student housing, convenience store portfolios, grocery stores, motel/hotel properties, manufacturing companies, transportation companies, wind farms, farms and ranches, professional service firms, and start-up entrepreneurial ventures. He has advised on transactions with or without real estate.

For nine years, Neil taught economics and upper division finance at Dixie State University. His courses include Real Estate Finance, Entrepreneurial Finance, Financial Modeling and Decision Making, Intro to Economics, and Macro Economics. Previously he priced derivatives and structured products and helped create risk metrics for the North American Gas and Power Trade Floor at ConocoPhillips.