Multifamily Snapshot

Las Vegas | Q2 2021

Average Sales/Unit

180K

Avg Rents

$1,300

Average Vacancy

4.19%

Expiring eviction moratorium helps drives sales volume to over $1 billion in second quarter.

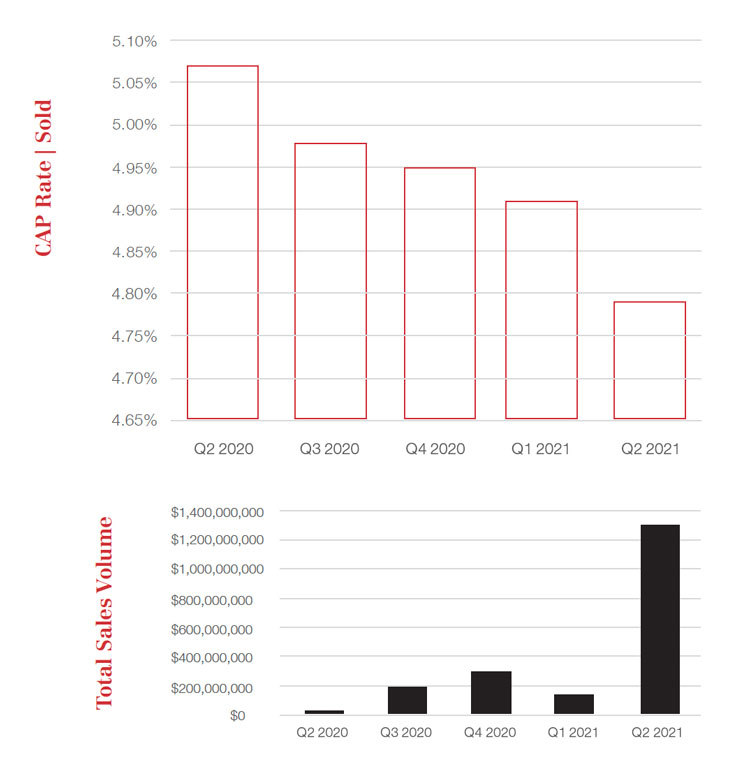

The Las Vegas Multifamily market nearly doubled the previous quarter in number of sales transactions with 62 total sales comprising 6,577 units. Total sales volume exceeded $1 billion for the first time since 2019. Investor interest and confidence continues to stay strong and cap rates have continued to compress below 5.0%. Market-wide, the average sales price per-unit has increased 13% year over year.

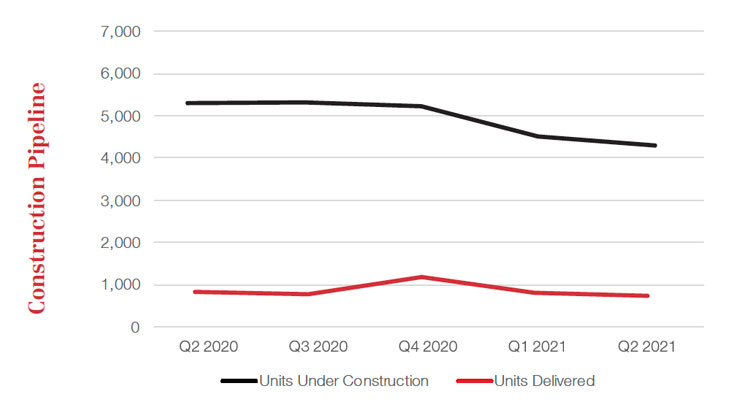

Helped by a strong inflow of new residents, apartment vacancies hit a low of 4.2% with apartment absorption having a net increase of 2,471 units occupied in the second quarter. This strong demand has caused rents to grow over 18% year over year. Under construction units has slightly decreased to 4,150 units, down from 5,283 units under construction in the second quarter of 2020, and 766 new units delivered this past quarter.

Significant Q2 Transactions

| Name | # of Units | Year Built | Sales Price | Submarket |

|---|---|---|---|---|

| Tuscan Highlands | 304 | 2020 | 115M | S. Las Vegas |

| Vue at Centennial | 372 | 2016 | 112M | Centennial Hills |

| Firenze | 462 | 2004 | 100.25M | Henderson |

| Accent on Rainbow | 540 | 1984 | 90.24M | Las Vegas |

| Norterra Canyon | 426 | 2007/2018 | 86.5M | N. Las Vegas |

| Lantana | 516 | 1980/2005 | 80M | Canyon Gate |

| Villa Serena | 288 | 1996 | 68M | Henderson |

| Sedona at Lone Mountain | 321 | 1999/2009 | 67.7M | N. Las Vegas |

| Azure Villas | 312 | 2007 | 62.3M | N. Las Vegas |

| Prelude at the Park | 320 | 1996 | 60.4M | Henderson |

| St. Clair Apartments | 187 | 2003 | 51M | Spring Valley |

| Accent on Decatur | 313 | 1978 | 46.77M | Richfield |

| Accent on Sahara | 312 | 1983 | 45M | Sunrise Manor |

| Azure Villas 2 | 186 | 2008 | 37.1M | N. Las Vegas |

| Tides at Spring Valley | 218 | 1987/2016 | 36.9M | Richfield |

| Tides at Cheyenne | 408 | 1999/2016 | 35M | Sunrise Manor |

This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty, or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction on the suitability of the property for your needs.

Michael Albanese

With over 12 years of Multifamily Management, Michael brings a wide range of skills and experience tailored towards Multifamily investing. With his knowledge of the local market, sales/rental trends, performance obstacles, multifamily specific financials, and asset capital scopes/ROI, Michael offers a unique insight into Multifamily Value add opportunities for his clients and potential investors.

About NAI Vegas and NAI Excel

NAI Excel and NAI Vegas are leading providers of commercial Real Estate Services in the West. Operating as NAI Vegas in Nevada, and NAI Excel in Utah and Idaho, we are part of the NAI Global network covering nearly every major market nationally and across the globe. Serving both urban and rural markets, we leverage our resources to help you excel in your real estate goals. When you work with one of our team, you get the benefit of working with all of us.

About NAI Global

NAI Global is a leading global commercial real estate brokerage firm. NAI Global offices are leaders in their local markets and work in unison to provide clients with exceptional solutions to their commercial real estate needs. NAI Global has more than 375 offices strategically located throughout North America, Latin America and the Caribbean, Europe, Africa and Asia Pacific, with 6,000 local market professionals, managing in excess of 1.15 billion square feet of property and facilities. Annually, NAI Global completes in excess of $20 billion in commercial real estate transactions throughout the world.

NAI Global provides a complete range of corporate and institutional real estate services, including brokerage and leasing, property and facilities management, real estate investment and capital market services, due diligence, global supply chain and logistics consulting and related advisory services. To learn more, visit http://www.naiglobal.com