Reduce Your Tax Liability, Buy Commercial Real Estate

- The Tax Cuts and Jobs Act allows for 5 and 15 year property to be fully depreciated in the year the property is put in service.

- This provision benefits those who need depreciation tax benefits today more than in the future.

- Benefits could be up to 10 times larger in year 1.

- You may be able to offset taxable income for prior years.

- Consult your tax professional to determine what is appropriate for to your situation.

If you have had strong income or expect to have a significant taxable income this year, investing in real estate may help. You can either pay the IRS, or do something they have incentivized you to do that allows you to keep your hard earned income.

It is not unusual for the tax code to use taxes to incentivize certain types of investment. For example, if you make financial contributions to a qualified retirement accounts, those contributions are deductible and reduce your overall taxable income, which reduces the amount of taxes owed in the year you make the investment.

Depreciation Benefits for Real Estate

Real estate assets differ from financial assets like stocks in that a portion of real estate gets consumed with time and is replaced. A real estate asset is part indestructible asset (the land) and part consumed asset (the improvements). Tax law recognizes improvements are consumed by allowing investors to depreciate the improvements but not the land. Depreciation is the reduction in value over time for the normal wear and tear of an asset. The amount of depreciation allowed is determined by a schedule provided by the IRS.

It has been known for many years that the IRS will allow a cost segregation study on real estate assets. This study is prepared by a professional who evaluates the real estate based on the property type, age, and nature of the improvements. Instead of being depreciated over 39.5 years, a cost segregation study separates the property into 5 year, 15 year, and 39.5 year improvements. For example, 15 year improvements are those improvements that have to be replaced in approximately 15 years because their useful life has been exceeded. This may include tenant improvements, the roof, or the HVAC system.

Segregating improvements into their respective 5, 15, and 39.5 year useful lives provides larger deductions in earlier years relative to a standard 39.5 year depreciation schedule. Given that depreciation reduces taxable income and assuming that depreciation today is more valuable than depreciation in the future, accelerated depreciation is valuable.

2017 Tax Law Allows for Accelerated Depreciation

President Trump’s tax law, Tax Cuts and Jobs Act, passed in 2017 made a substantial change to depreciation that benefits commercial real estate owners. It allows for 5 and 15 year property designated in a cost segregation study to be fully depreciated in the year the property is put in service. That means that if you purchase and put in use a property in 2020 and the property has $500,000 in 5 and 15 year improvements, then the owner could deduct up to $500,000 in depreciation in 2020.

Also significantly, the tax law in certain cases authorizes you to use the depreciation benefits to offset prior year income. You need to discuss this with your tax professional to determine if you qualify for this treatment.

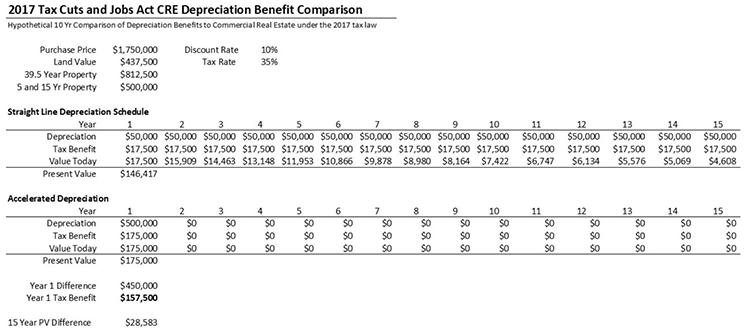

Exhibit 1 shows a hypothetical $1,750,000 investment purchase where the value is allocated to land ($437,500), 39.5 year improvements ($812,500), and 5-15 year property ($500,000). In year 1, without cost segregation and accelerated depreciation, the straight line benefit on the 5 and 15 year property is $50,000 * 35% (the hypothetical tax rate), or $17,500. Under the 2017 tax law, additional depreciation benefits in Year 1 are $450,000, which at a 35% tax rate are worth $157,500. This means that in the year this hypothetical property is put into use, buying the property could save the investor $157,500 in income tax expense—or 9% of the property value.

There is always a catch. Accelerating depreciation reduces your basis in the property so that when it is time to sell, your gain is larger than if you had not accelerated the depreciation. That means your tax liability is larger when you sell in the future. Of course, you can exchange the property and defer the tax liability even further by utilizing a 1031 exchange.

What About Investors?

The best benefits are for property owners, but investors can accelerate depreciation to offset up to 100% of the future income generated from the project. As always, please consult your tax professional to determine how the new tax law applies to you.

Conclusion

There are may investment opportunities available to investors. All of them have their respective benefits. Financial assets like stocks, bonds, and mutual funds can be held in tax deferred accounts that allow for investments to accumulate while deferring tax liability. Benefits to owning real estate include the ability to depreciate the consumable portion of the asset over its useful life. The depreciation benefits are set by the IRS and were revised in the 2017 Tax Cuts and Jobs Act. The revision resulted in the ability to accelerate depreciation and reduce taxable income today. This can be a valuable benefit for investors looking to offset taxable income from real estate investments.

R. Neil Walter, MBA, CFA

Neil is both partner and CEO for Brokers Holdings (NAI Excel). His client base is primarily focused on investment properties, development land, special use assets with or without the accompanying business, and difficult to sell REO properties. Neil’s professional experience is built on a capital markets foundation of deal structuring, cash flow modeling, and asset pricing. He has worked on projects including development land, multifamily and student housing, convenience store portfolios, grocery stores, motel/hotel properties, manufacturing companies, transportation companies, wind farms, farms and ranches, professional service firms, and start-up entrepreneurial ventures. He has advised on transactions with or without real estate.

For nine years, Neil taught economics and upper division finance at Dixie State University. His courses include Real Estate Finance, Entrepreneurial Finance, Financial Modeling and Decision Making, Intro to Economics, and Macro Economics. Previously he priced derivatives and structured products and helped create risk metrics for the North American Gas and Power Trade Floor at ConocoPhillips.